News

Banks Urged To Reject Updated Debt Exchange Deal

Published

3 years agoon

By

M N Ridwan

Commercial banks have been told not to accept the updated debt exchange offer by the Ghana Association of Banks (GAB) due to the lack of clarity regarding how the debt restructuring will affect the banking sector.

In a letter to bank managing directors, the association requests that its issues be resolved before accepting the debt swap offer.

To that effect, GAB advised member banks to officially notify the association first before considering the debt swap in its present form.

It iterated in a statement as follows:

“From the uncertainty surrounding the program, GAB recommends that all banks must stay any further movement on the exchange until our demands have been met.

However, in the event that a bank may have to move forward to exchange, the MD/CEO must inform the CEO of GAB directly of the decision.”

The decision was reached after a high-level meeting with various parties, including the Bank of Ghana, debt management advisors GABS, the Vice President, the Minister of Finance, and the Vice President.

According to the intercepted document, the banking group’s leadership made multiple requests at the conference to lessen the impact of the domestic debt swap program on the banking industry.

The International Monetary Fund and Africa’s second-largest gold exporter have inked a staff-level agreement for a $3 billion bailout plan.

The board’s approval, though, depends on a successful debt restructure that lowers the nation’s debt servicing costs.

According to a Friday report, banks were reluctant to join the scheme, adding to the litany of uprisings against the domestic debt exchange.

According to the report, “the banking industry will lose over GHS 5.9 billion in income alone if the debt exchange program is implemented in its current form, experience a loss before tax of nearly GHS 14.5 billion, and have a liquidity shortfall exceeding GHS 20 billion.”

The debt exchange would result in a significant loss of jobs, according to the banks, as they would have to curtail their operations.

In order to encourage greater participation, the association wants the debt swap program sign-up date of January 16 to be extended although the deadline has already been extended twice by the government.

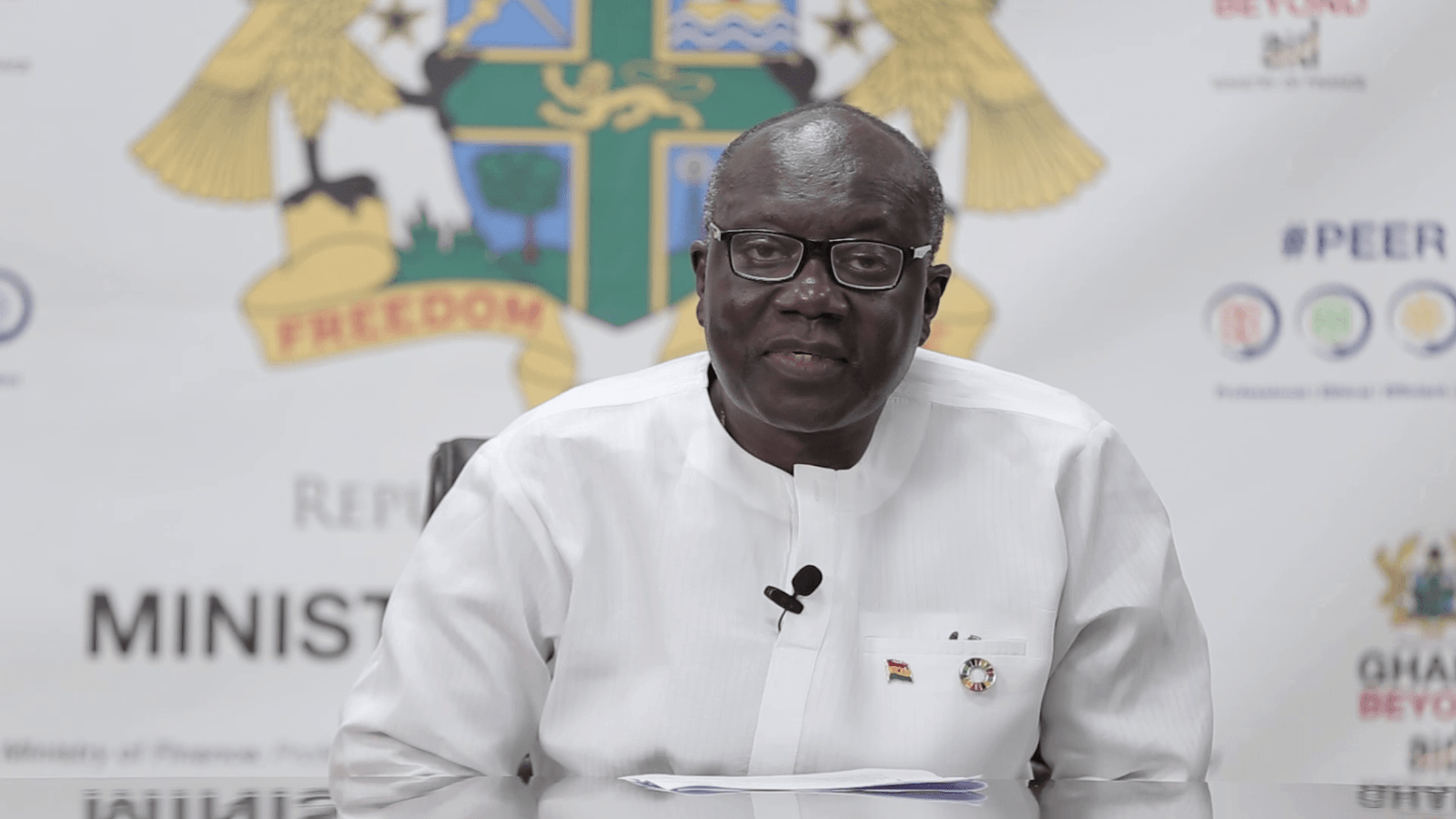

The Finance Minister and the French consulting firm Lazard opposed the request, despite the fact that many stakeholders at the high-level meeting seemed to support the idea of extending the deadline for a third time.

They contend that any further extension of the deadline will undermine the debt swap program’s credibility.

Conclusion

Stay tuned for more interesting news updates.